If you’re an S-Corporation shareholder, you’ve got some brand new tax reporting requirements to fulfill this year. We know this is probably the last thing you wanted to hear, but correctly filing this information is crucial to accurate tax reporting and avoiding potential issues with the IRS. We’re here to provide you with everything you need to know about the new form and reporting requirements, so you don’t have to deal with these issues.

Change of Base

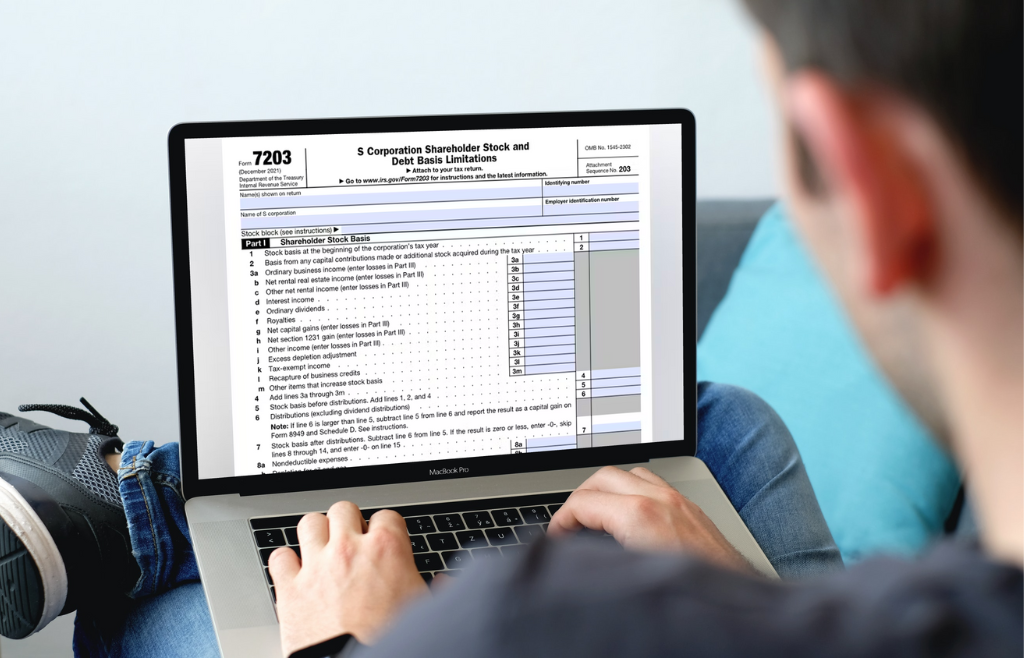

The goal of this new form is to create a more rigid report of shareholders’ tax basis. Similar to the changes brought on in 2018, which require shareholders to report their own tax basis schedule, the new form takes the information usually provided by the K-1 statement and provides a method to calculate a more accurate tax basis per individual. Because this process was often glossed over by shareholders, the IRS has deemed it necessary to calculate a more specific tax basis to be included in income tax returns. Many shareholders would previously determine their own tax basis without adjusting the information provided by the K-1 statement, leading to less-than-accurate reporting. Now, the calculations to determine your tax basis are included on the form, so that the IRS can verify.

Who Has to Use the Form?

The reporting requirements are similar to the changes made in 2018. Any S-corporation shareholder who meets at least one of these requirements must file a Form 7203:

- Received a distribution

- Received a loan repayment from the corporation

- Disposed of their stock

- Claimed a deduction for losses

Shareholders should be sure to maintain records of their basis yearly, both for their own records and to keep a consistent calculation for the years that they will have to file a Form 7203. The form itself includes a worksheet that will take the information provided by your K-1 statement, and guide you through the calculations necessary to accurately determine your new tax basis.

While this change only adds more complexity to your yearly tax return, maintaining a history of your tax basis (even in years where you don’t have to use the form) is a good habit to develop in case of a discrepancy with the IRS, and to keep for your own records. If your business is in need of tax planning assistance or legal counsel in any of our many areas of business law, contact the Law Offices of Tyler Q. Dahl today.