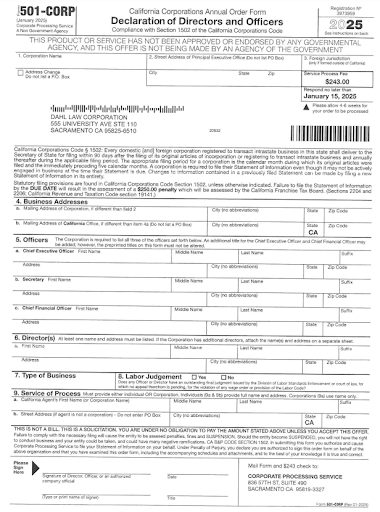

Have you received a form similar to this in the mail?

You’re not alone. California business owners, homeowners, and anyone who owns real property may recognize this and similar mailings. It looks very official due to the intentional design reflecting forms taxpayers and business owners are used to seeing from the Internal Revenue Service (IRS).

Turns out—it’s a scam. There is nothing genuine about this document. In the fine print near the bottom, you see “THIS IS NOT A BILL. THIS IS A SOLICITATION. YOU ARE UNDER NO OBLIGATION TO PAY THE AMOUNT STATED ABOVE UNLESS YOU ACCEPT THIS OFFER.” This is a business trying to sell our law firm something.

So, how should you proceed if you receive the same or a similar document?

Why Did I Receive This Document?

It can be alarming and confusing to receive documents like this shortly after forming an LLC or corporation. The timing is intentional. What many fail to understand is that forming a business is a matter of public record. Opportunistic companies watch public records to target new business owners, hoping to capitalize on the whirlwind of decisions and actions required in the early stages of business formation.

These companies are closely watching public records to get unsuspecting and fresh business owners to catch them in the whirlwind that comes with business formation. You are trying to move your business forward in the early stages, so some people simply fill these out, pay the fee, and often receive a service that was either free or significantly cheaper than what they paid if they had just done so themselves.

In the example above, what they’re really doing is filing your California Statement of Information, which costs only $20 to file on your own. Their services are unnecessary and significantly overpriced.

Is This Illegal?

While misleading, this tactic isn’t illegal. The companies behind these solicitations carefully avoid directly claiming to represent a government agency. Instead, they push the boundaries of impersonation without crossing legal lines. By including disclaimers—such as the fine print stating the document is a solicitation—they comply with the law. Their approach hinges on confusion and a lack of clarity, exploiting busy or inexperienced business owners.

How to Respond to Documents Like This

The short answer to this is: Don’t.

The more professional answer is: Look into what it is the company is attempting to sell you and decide if you or your company need it.

If you decide you do, delegate the task to someone on your team to take care of it yourself as it will often be as much as 90% cheaper to do it yourself rather than paying a company hundreds or even thousands of dollars to do it for you.

Protect Your California Business Interests

Documents like this are a reminder of the challenges California business owners face beyond day-to-day operations. Dahl Law Group proudly supports legitimate businesses as a trusted partner for business owners and executives, offering personalized business law support to protect your interests both short and long-term. Whether you need help navigating laws and regulations, business litigation, or addressing legal issues that arise during business operations, our team is here to assist. Contact our offices in Sacramento and San Diego today to discuss how we can support your business goals.